Sony Bank introduces "SPA Cloud" for centralized management of mortgage loan examination documents

In cooperation with Salesforce, it is possible to search for and find a document among millions of customer folders in about 4 seconds.

WingArc1st Inc.

WingArc1st is pleased to announce that Sony Bank, which provides asset management products and services for individuals using the Internet, has introduced "SPA Cloud" as its platform for managing documents. It has also been integrated with Salesforce to improve the efficiency of mortgage loan examination work.

Background:

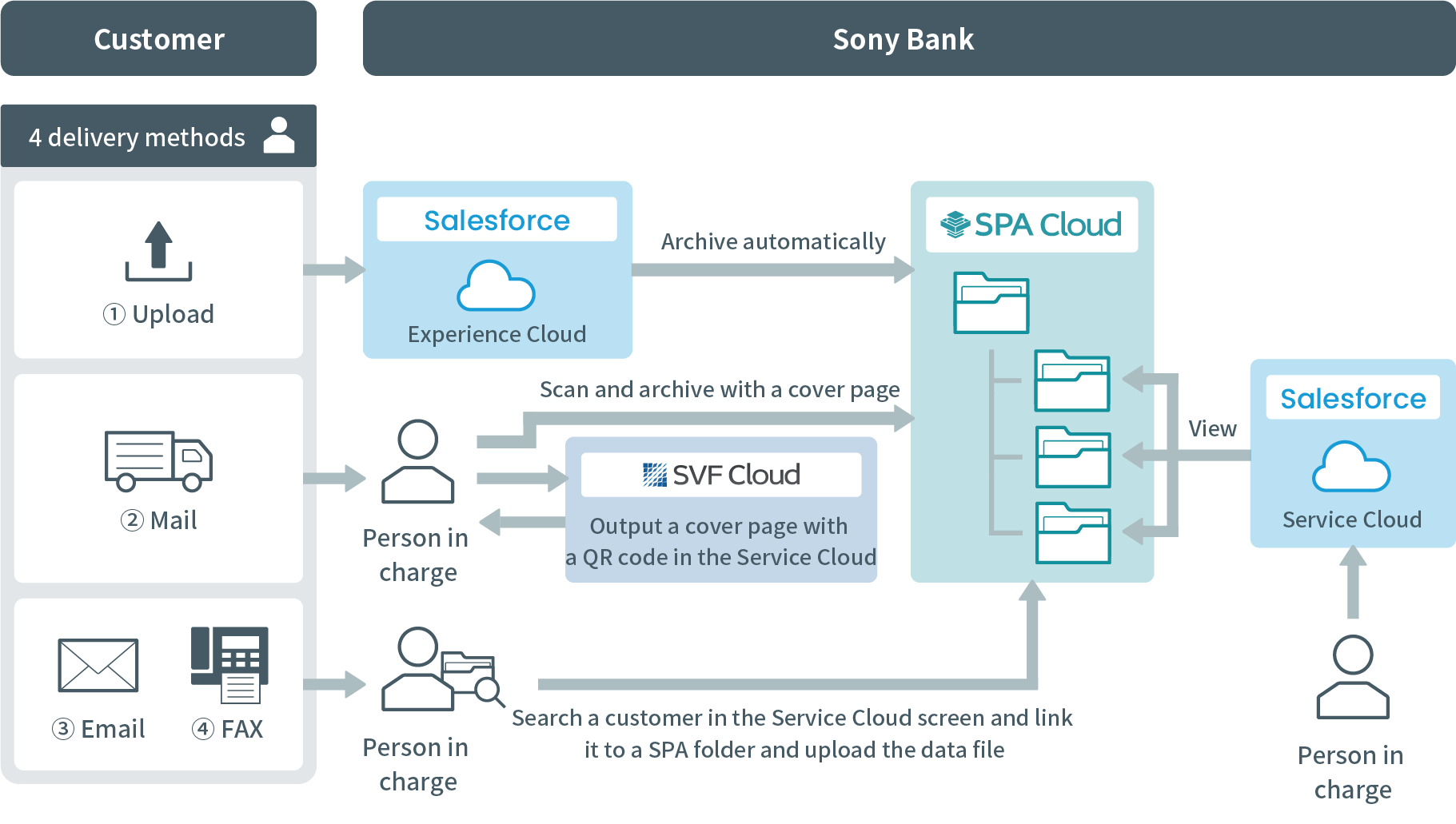

When examining mortgage applications, it previously took Sony Bank three to five weeks from the receipt of documents to announce the results of its examination. To shorten the review time and improve customer service, Sony Bank decided to add a method for customers to upload documents in alongside conventional methods of submitting documents by mail, email and fax. While this might be expected to improve customer convenience, it was assumed that the submission of documents by different routes prevented central management, and that their collation would continue to be a burden on the Operations Department.

After reviewing its existing methods of document management against feedback from the field, Sony Bank introduced "SPA Cloud" to manage efficiently and centrally all documents regardless of the route by which they were submitted.

The key capabilities underpinning Sony Bank's decision were:

・Its high affinity with Salesforce, which is responsible for its business operations

・"SPA Cloud's" capability to allow staff to work while treating electronic data like a paper document, such as adding highlights and markers.

・By integrating SPA Cloud with "SVF Cloud for Salesforce" (which Sony Bank has already introduced as a cloud service for managing business forms) the work of sorting mailed documents can be streamlined.

Benefits:

By introducing "SPA Cloud", Sony Bank now manages customer information and important documents centrally alongside Salesforce Service Cloud to reduce the operational load.

"SPA Cloud" centrally manages not only mortgage-related documents but also customer-related document data for the past 20 years, making it possible to search for and find a target folder among millions of folders in about 4 seconds. This has led to a reduction in work-related stress within the department.

In the future, Sony Bank will scan paper documents with artificial intelligence-based optical character recognition (AI OCR) to automate the distribution of documents, shorten the work time involved, and promote operational reforms. The Bank aims to further improve customer satisfaction by reducing simpler human tasks by simply storing documents in "SPA Cloud", thereby increasing the amount of time spent interacting with customers. WingArc1st will continue to support Sony Bank's utilization of "SPA Cloud".

Use Case:

https://www.wingarc.com/product/usecase/415.html (Japanese)

About Sony Bank:

An internet bank that provides high quality financial services such as domestic and foreign currency deposits, investment trusts, mortgages, and debit cards.

https://sonybank.net/ (Japanese)

https://moneykit.net/en/

Contact on Products and Services:

WingArc1st Inc.

Roppongi Grand Tower, 3-2-1 Roppongi, Minato-ku, Tokyo106-0032, Japan

TEL : 81-3-5962-7300

FAX : 81-3-5962-7301

E-mail :

Inquiry on This Press Release:

WingArc1st Inc. PR team: Yamamoto, Nakatani, Iisaka, Furusho

TEL : +81 90 5391 1510 (Yamamoto) , +81 80 3006 2396 (Furusho)

E-mail :

*Company names and products names enlisted in this Press Release are trademarks or registered trademarks of each company.